The poster child, so to speak, for serendipitous innovation has to be the Post-it by 3M.

By happy accident, an orphan adhesive technology developed by one scientist was married to a need from a fellow scientist for bookmarks that wouldn’t fall out. The Post-it was born and the rest is history. Today, Post-it is a billion dollar brand for 3M and leads the sticky note category.

Clearly waiting for random encounters between existing technologies and consumer needs is not a sound innovation strategy. So the goal of any company today is to create conditions that increase the odds that innovation will emerge from the primordial ooze of data and knowledge contained within the company.

There is added urgency as innovation teams have come under tremendous pressure in recent years as structural changes have occurred in the global business landscape that have made lower cost innovation more important as a component of topline and bottomline growth, and forced the acceleration of product launch cycles. Doing more, more quickly, with fewer resources has become the name of the game for many involved in innovation.

The good news is that there are four clear steps companies can take that increase the odds of innovation opportunities emerging, which I’ll address below. You just have to know where to look and create an environment that facilitates the right sort of connections. This sounds a lot like the role of AI, and certainly AI holds tremendous potential. The beauty of these four steps, however, is that they will produce results immediately and are in many ways prerequisites to implementing an AI based innovation approach.

First Some Essential Context:

1. The business environment is challenging and getting worse:

A recent McKinsey study titled Rescuing the Decade: A dual agenda for the consumer goods industry did a good job of summarizing some of the structural factors that have fundamentally changed the growth and profitability environment for consumer goods companies. Gone are the halcyon days of the 80’s through the early 2010’s when 9% annual topline growth and constant margins typified most CPG companies. Today, growth rates have slowed to 2-6% while profitability has dropped significantly.

McKinsey identified four megatrends driving this change.

- Macroeconomic slowdown - characterized by population growth stagnating, wealth expansion slowing, and China growth slowing.

- Consumer fragmentation - characterized by a shift to digital, growing interest in sustainable and healthier alternatives, and the impact of prescription weight loss drugs.

- Mass merchant squeeze - characterized by supermarkets losing share and struggling with profitability, and private label growth (particularly in Europe).

- Escalating, volatile costs - driven by inflation and heightened rate of crop failure.

Most of the drivers of these megatrends are forecast to remain constant or accelerate over the coming years, which leads McKinsey to conclude:

“CPG companies, therefore, face two urgent needs: renewing growth when opportunities are limited and reducing costs when companies have already done a lot.”

2. True new product innovation is declining significantly:

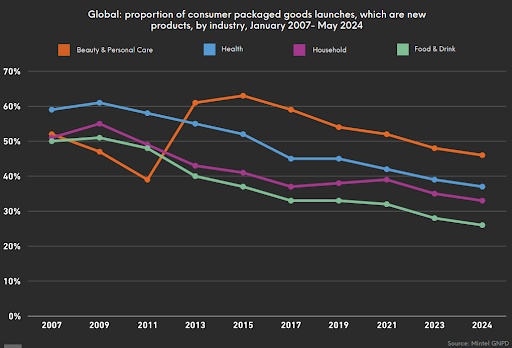

Mintel’s recent report on The Role of Innovation in the Future of the CPG Industry provides a very nice overview of the changes to the innovation landscape in CPG. To summarize very quickly: Continuing a trend that started almost 20 years ago, in the first half of 2024 new products (true innovation) represented only 35% of launches globally across CPG (the rest being renovation) - the lowest level recorded since Mintel GNPD started keeping records in 1996.

This represents a decline in innovation of roughly 30% across categories since 2007, with food and beverage faring the worst with a 50% decline.

3. The new products that are launched are not coming from large companies:

Furthermore, these new product launches generally are not coming from large, established companies. Circana’s most recent Pacesetter report (which tracks the top 100 new product launches across CPG and food and beverage) showed that 2023 had the lowest percent of launches by large manufacturers (>$8B in revenue) since 2017 at 8% (down from 15% in 2022). While launches by companies with less than $500m in revenue contributed 59% of pacesetters (up from 41% in 2022).

4. Product launch cycles are continuing to accelerate:

Another important factor contributing to the predicament facing innovation teams today is the acceleration of product launch cycles. What was once a two to three year process for most companies has been compressed to a matter of months in many cases. This acceleration is driven by a few factors, chief among them being:

- Consumer expectations for immediate gratification driven by the rampant spread of the latest trends globally through social media.

- The ability for smaller, more agile companies to capitalize on these trends very quickly through direct to consumer business models and social/digital media.

- The advent of AI further leveling the playing field and enabling smaller competitors to compete with larger players in terms of deriving insights, developing product concepts, creating marketing campaigns, and even performing customer service.

Four Key Steps to Uncovering Hidden Innovation Opportunities:

Clearly there’s a lot of excitement about the potential for AI to deliver innovation ideas, which will shorten the timeframe for innovation, increase the likelihood of success, and reduce costs. However before AI can start churning out game-changing innovation opportunities, you first need to have a sound set of structured data and documents for AI to ingest, or else you’ll fall prey to the garbage in garbage out truism.

Here’s the good news. Many of the same building blocks you need to have in place to prepare for using AI are also great places to start to identify innovation opportunities right now. The following are four approaches to uncover hidden innovation opportunities.

1. Understand the products you have: This may sound simplistic, but just the process of understanding your own portfolio can stimulate innovation. When I say understand your products, I’m primarily talking about two things:

• Create a global single source of truth that houses all of your products and all of the various claims (efficacy, health, sustainability, etc) that define those products. These claims are what define the value to consumers.

• Create a direct link between each of those claims and the substantiation for those claims, whether that substantiation takes the form of a document, website, or even the formula.

Doing these two things will enable you to leverage innovation or claims that may have been created on one product in one geography across other products and other geographies. This may take a very direct form, where a claim can be used on another product due to the same or very similar substantiation, or it may take a more indirect form through inspiration that occurs through cross pollination. It is important that the single source of truth is shared across functions, so marketers, product development, regulatory, R&D and other functions all have visibility.

2. Connect formula composition to consumer value: Many of the claims that define the value of your products to consumers rely on a specific component of the formulation or packaging composition. Sometimes this may be tied to a specific supplier due to the nature of their raw material or a certification.

Claims that rely on the composition of a product could be tied to the presence or absence of a substance or nutrient (e.g. paraben free, made with real honey), could be related to supplier certifications (e.g. organic, kosher), or could be tied to levels of specific substances or nutrients (e.g. contains calcium for strong bones). This same approach can be used for claims related to packaging composition (e.g. 100% post-consumer resin)

Understanding how composition impacts claims, and having those claims directly linked to composition will enable you to easily understand what claims are potentially available based on the composition of a formula or package. This can stimulate innovation ideas for existing or new products, and can help immediately clarify the product/claim implications of a change to formula composition or a supplier for a given raw material

3. Leverage the potential of your existing research, studies and tests: All too often the studies and tests performed by R&D and market research teams that may support substantiation or hold the keys to innovation opportunities are filed away on a shared drive or hard drive, perhaps known only to the researcher and a few others. These studies hold tremendous potential for innovation, but due to their inaccessibility only a small portion of that potential may ever be realized.

Studies and test reports should be housed in a common location, key metadata and results should be recorded as structured data and attached to any documentation, and the contents of any documents should be searchable. Furthermore, studies should be linked to formulas with the formula composition exposed.

When studies and tests are managed in an organized, data driven manner such as this, it becomes possible to better understand the claim and consumer value potential of formulas based on prior studies, search for studies on similar formulas that may support specific claims, and even drive formulation decisions made to achieve specific claims, all based on this past body of work. Furthermore, unmet consumer needs from market research can be married up more easily to potential technical solutions.

4. Unlock your connected cross-functional ecosystem: The final key to uncovering innovation opportunities that may be lying at your feet is unlocking the connected ecosystem across functions responsible for research, product development, and commercialization. Very often functional silos exist, in which each function performs its responsibilities in relative isolation, but there are no mechanisms in place to foster rapid collaboration, sharing of consistent data sets, or rapid understanding of the implications of change anywhere in the ecosystem.

When silos are removed and all functions are interconnected in the form of workflows, common data and documents, clarity around common objectives, and transparency around upstream and downstream interdependencies, this has the effect of applying an electric charge to the aforementioned primordial ooze. Innovation ideas can come from any point in the connected ecosystem. For example, someone in regulatory affairs might learn about an upcoming tightening of formulation restrictions in a certain country - this information can flow immediately to R&D who can identify compliant formulas that may still deliver desired claims for marketing. Similarly, a new consumer trend may drive desired claims for an innovation project - at the same time, regulatory restrictions around formulas in specific target countries can influence formulation options early in the process, limiting consideration to truly viable alternatives.

Connecting all functions also has the added benefits of accelerating the innovation process overall, and delivering the agility to pivot quickly when interdependencies are clear and understood across the organization.

Closing Thoughts:

There’s no doubt that innovation has fundamentally changed since many many of us started our careers in CPG. Innovation cycles are faster, trends change more quickly, and new competitors can emerge very rapidly. This has put tremendous pressure on the cross functional teams engaged in the process of innovation. While many are pinning their hopes on AI to deliver rapid innovation, this is dependent on a sound underpinning of structured data, documents and other knowledge within the company. The good news is that there are places to look to find innovation opportunities today within your four walls. Furthermore, the steps required to bring these opportunities to light generally are the same steps that companies need to take to prepare for an AI driven innovation approach. Reach out to learn more about how Veeva can help.

SHARE